For MSFT MSFT, we notice a put option trade that happens to be bearish, expiring in 7 day(s) on November 5, 2021.There were 355 open contracts at this strike prior to today, and today 943 contract(s) were bought and sold. The total cost received by the writing party (or parties) was $32.7K, with a price of $385.0 per contract. Parties traded 85 contract(s) at a $295.00 strike. It expires in 7 day(s) on November 5, 2021. Regarding TWLO TWLO, we observe a call option trade with bullish sentiment.There were 881 open contracts at this strike prior to today, and today 1579 contract(s) were bought and sold. The total cost received by the writing party (or parties) was $394.8K, with a price of $1325.0 per contract. This particular call needed to be split into 4 different trades to become filled. Parties traded 298 contract(s) at a $185.00 strike. Regarding NET NET, we observe a call option sweep with bearish sentiment.

There were 22 open contracts at this strike prior to today, and today 4492 contract(s) were bought and sold. The total cost received by the writing party (or parties) was $250.6K, with a price of $520.0 per contract. This particular call needed to be split into 27 different trades to become filled. Parties traded 482 contract(s) at a $100.00 strike. It expires in 21 day(s) on November 19, 2021.

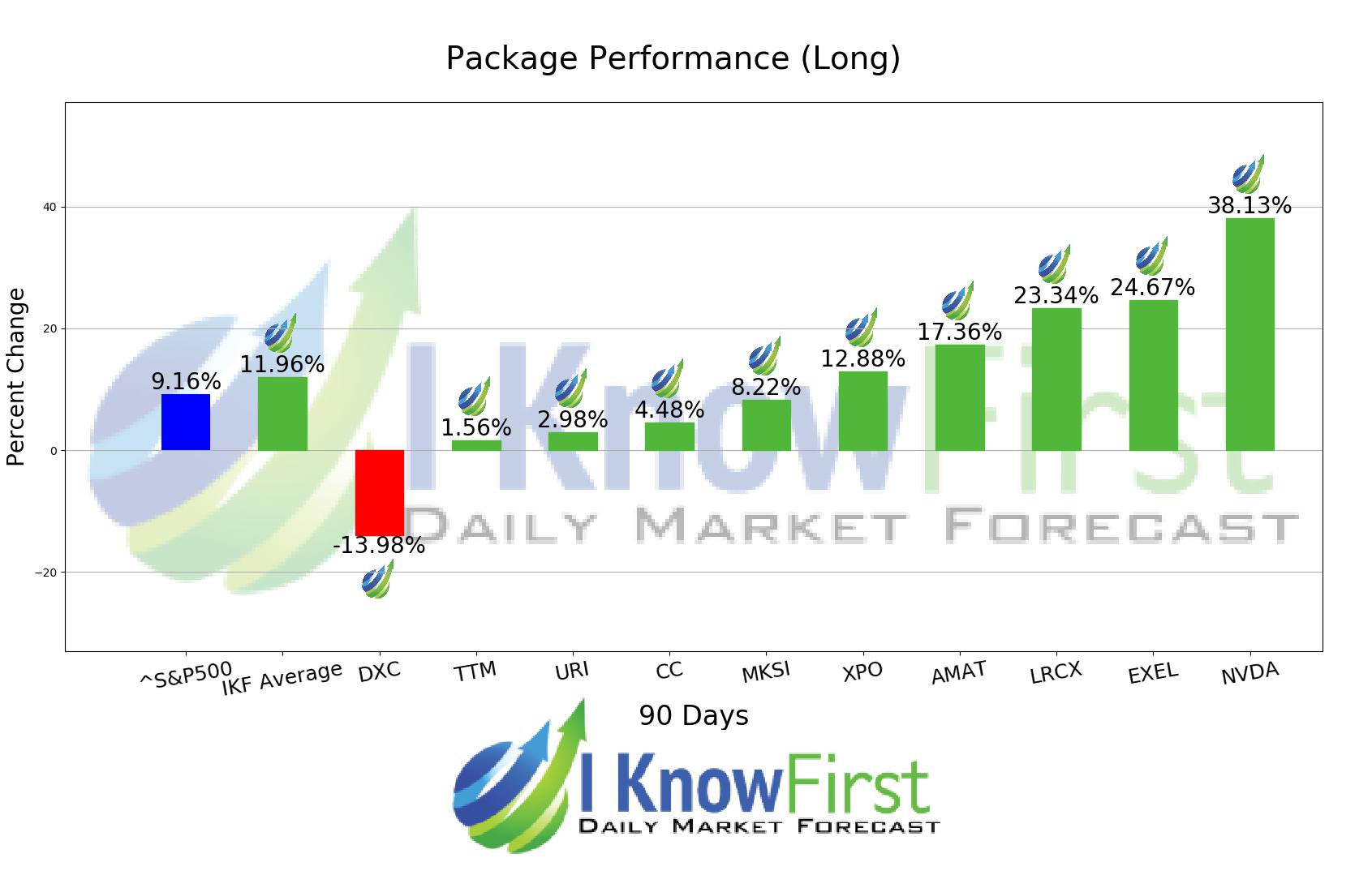

Regarding ZEN ZEN, we observe a call option sweep with bullish sentiment.There were 2958 open contracts at this strike prior to today, and today 4683 contract(s) were bought and sold. The total cost received by the writing party (or parties) was $81.6K, with a price of $183.0 per contract. This particular call needed to be split into 29 different trades to become filled. This event was a transfer of 449 contract(s) at a $123.00 strike. For AMD AMD, we notice a call option sweep that happens to be bullish, expiring in 7 day(s) on November 5, 2021.There were 7260 open contracts at this strike prior to today, and today 9071 contract(s) were bought and sold. The total cost received by the writing party (or parties) was $34.8K, with a price of $58.0 per contract. This event was a transfer of 600 contract(s) at a $49.00 strike. For INTC INTC, we notice a call option trade that happens to be bearish, expiring in 7 day(s) on November 5, 2021.There were 5964 open contracts at this strike prior to today, and today 34979 contract(s) were bought and sold. The total cost received by the writing party (or parties) was $30.5K, with a price of $250.0 per contract. This particular call needed to be split into 3 different trades to become filled. Parties traded 122 contract(s) at a $252.50 strike. For NVDA NVDA, we notice a call option sweep that happens to be bullish, is expiring today.There were 88983 open contracts at this strike prior to today, and today 36285 contract(s) were bought and sold. The total cost received by the writing party (or parties) was $200.8K, with a price of $279.0 per contract. This event was a transfer of 720 contract(s) at a $150.00 strike. For AAPL AAPL, we notice a call option trade that happens to be bullish, expiring in 21 day(s) on November 19, 2021.These itemized elaborations have been created using the accompanying table. Lam Research Corp.Here's the list of options activity happening in today's session: Symbol If you want to learn more about Lam Research visit their website at If you are good with personal finance and are looking to invest, you will find the Lam Research on NASDAQ stock exchange. Trading in bull markets is always easier so you might want to favor these shares under the given circumstances, but always read up on optimal investment strategies if you are new to investing. Since this share has a positive outlook we recommend it as a part in your portfolio. Our Ai stock analyst implies that there will be a positive trend in the future and the LRCX shares might be good for investing for making money. Currently there seems to be a trend where stocks in the Technology Manufacturing sector(s) are not very popular in this period.

According to present data Lam Research's LRCX shares and potentially its market environment have been in bearish cycle last 12 months (if exists). Recommendations: Buy or sell Lam Research stock? Wall Street Stock Market & Finance report, prediction for the future: You'll find the Lam Research share forecasts, stock quote and buy / sell signals below.

0 kommentar(er)

0 kommentar(er)